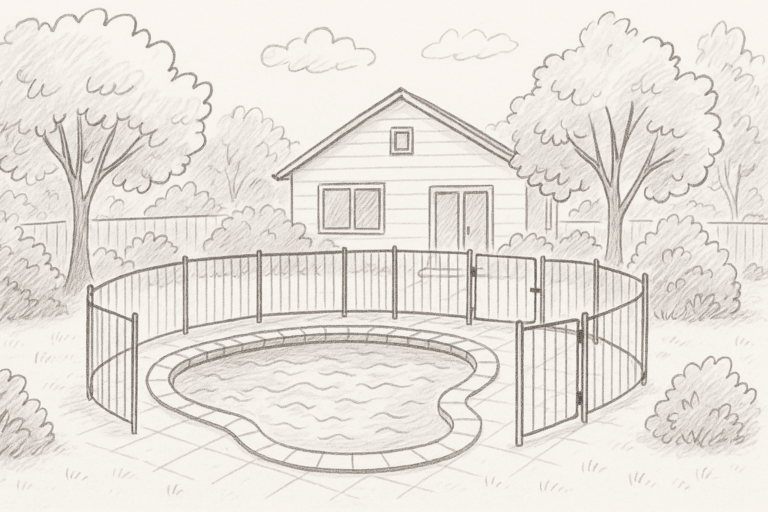

Adding a swimming pool to your property changes more than just your backyard—it changes your insurance needs. Home insurance with pool coverage brings higher liability risks, potential premium increases, and new conversations with your insurer that shouldn’t be ignored. Whether…

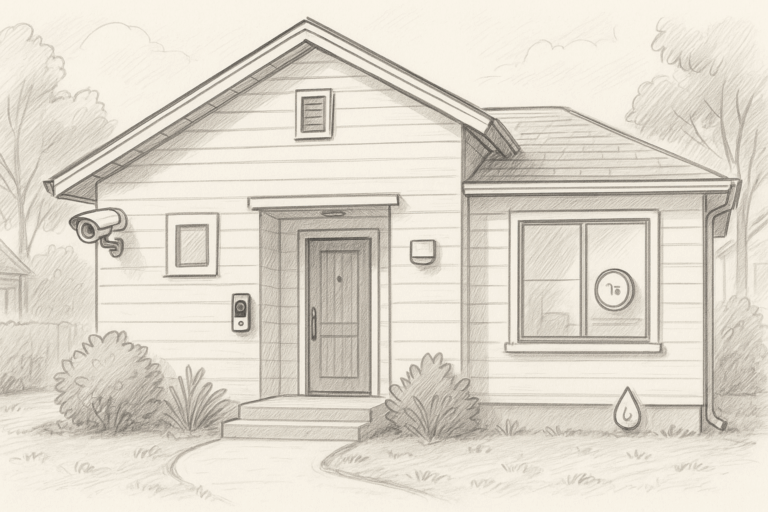

Smart tech home insurance is becoming a key trend in how homeowners manage risk, protect property, and potentially lower premiums. As smart devices like leak sensors, video doorbells, and thermostats become more common, insurance companies are adapting their policies to…

Short-term rental insurance is one of the most overlooked yet critical parts of running a profitable rental business. Whether you’re listing a spare room or managing multiple properties, relying on standard homeowners or landlord insurance can leave you dangerously exposed.…

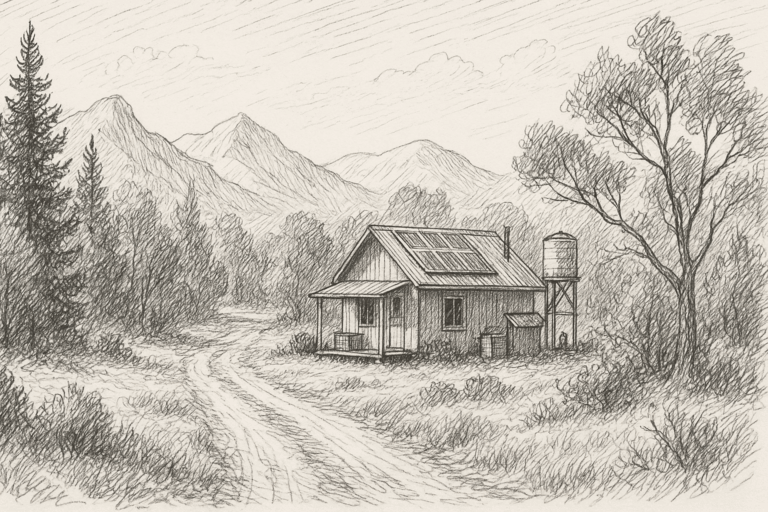

Remote home insurance is not a one-size-fits-all solution. Homes located in rural, off-grid, or hard-to-reach areas face a unique set of challenges that standard homeowners policies often don’t fully cover. From wildfire risks to limited access to emergency services, living…

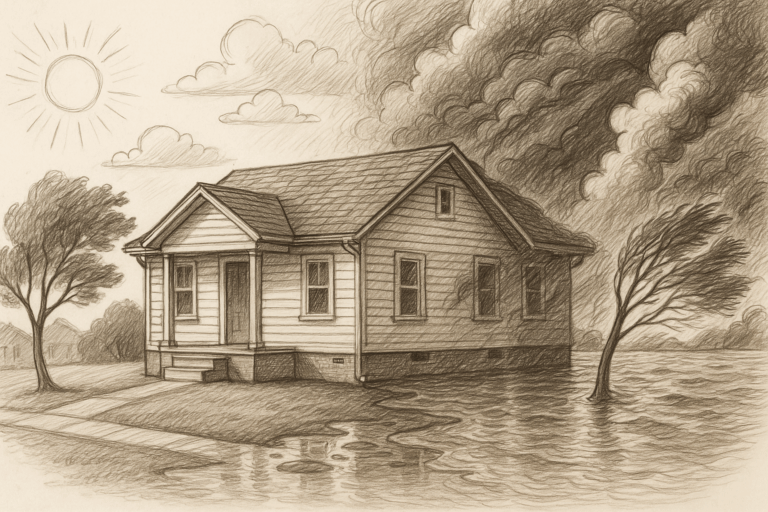

Climate change home insurance is quickly becoming one of the most urgent topics in the property market as extreme weather events grow more frequent and destructive. From wildfires to floods, the financial toll of climate-driven disasters is forcing insurance providers…

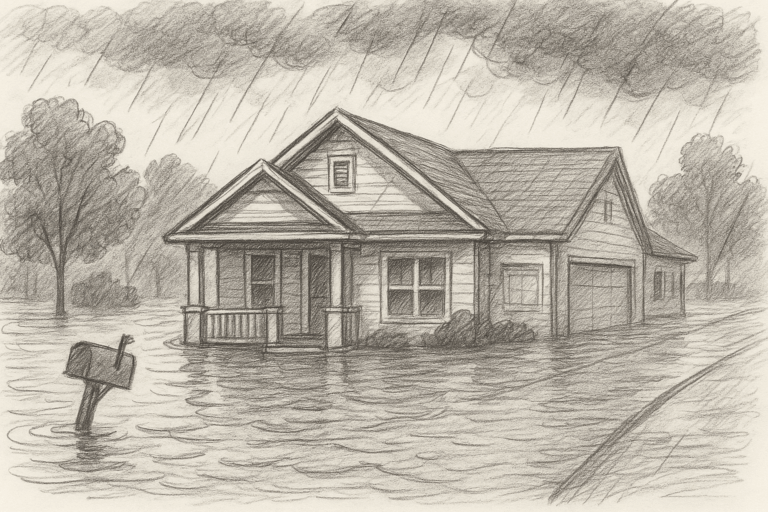

Flood insurance for homeowners is a critical yet often misunderstood part of protecting a property, especially in areas prone to rising water levels and severe storms. Many people don’t realize until it’s too late that a standard homeowners insurance policy…

Updating home insurance isn’t something most people think about—until it’s too late. Whether you’ve remodeled your kitchen, bought new furniture, or experienced a major life change, your current policy may no longer reflect the true value of your home or…

Condo homeowners insurance is one of the most misunderstood types of property insurance, often leaving owners unsure of what they’re really covered for. Unlike traditional homeowners insurance, this policy is designed specifically for condominium units, where ownership is limited to…

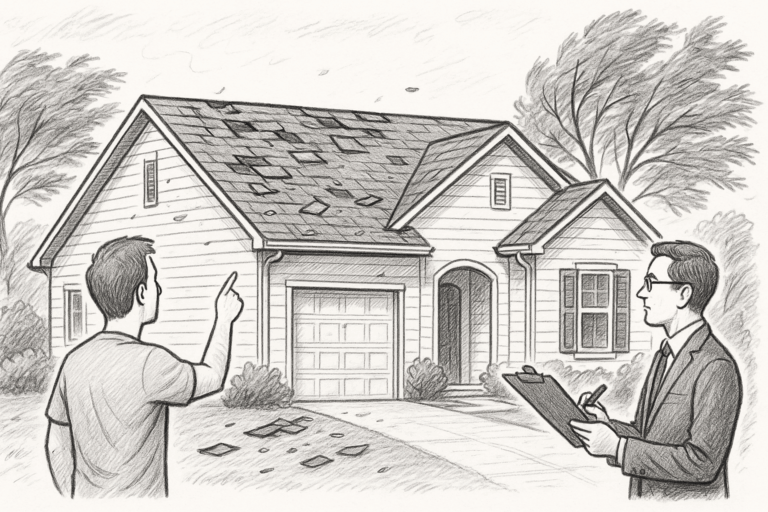

Roof damage insurance claims can be confusing and time-sensitive, especially after a major storm or unexpected incident. For homeowners, knowing how to approach the claims process can mean the difference between a full payout and a costly repair bill. Whether…

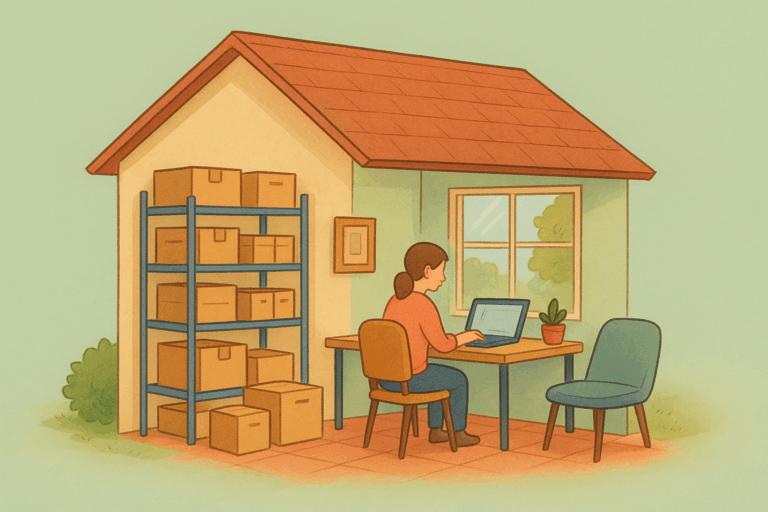

Running a business from home comes with freedom and flexibility, but it also brings responsibility. One major area many entrepreneurs overlook is protection — specifically, the need for home-based business insurance. While it might seem like your homeowner’s policy has…