Home insurance myths cause many homeowners to misunderstand what their policy actually covers. These misunderstandings often lead to surprise expenses, denied claims, or gaps in protection that only become clear after damage occurs. While homeowners insurance is designed to protect…

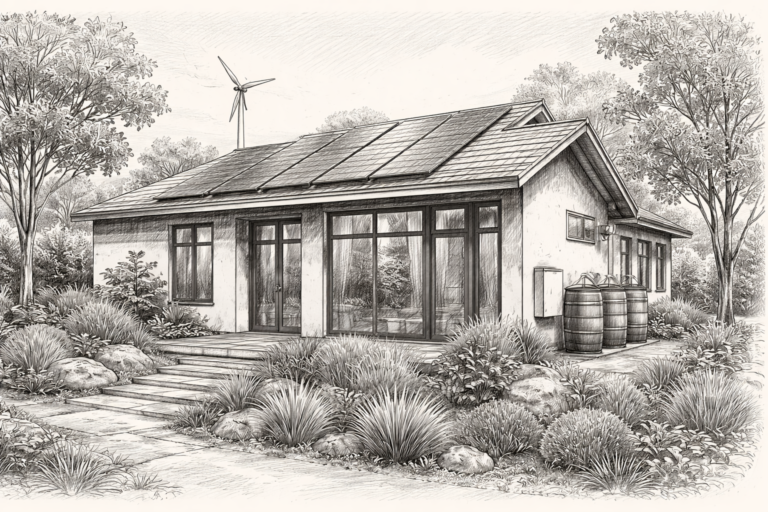

Eco-friendly home insurance is becoming an essential consideration for homeowners who invest in sustainable design, renewable energy systems, and environmentally responsible building materials. As more people choose solar panels, energy-efficient appliances, recycled construction materials, and net-zero designs, traditional homeowners insurance…

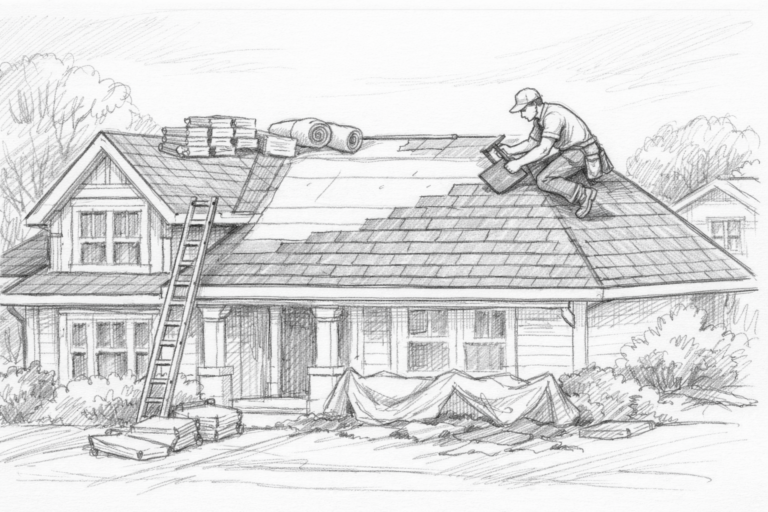

New roof home insurance savings can significantly reduce your homeowners insurance premiums while strengthening your property’s overall protection. Insurance companies assess risk based on the likelihood of future claims, and your roof plays a central role in that calculation. An…

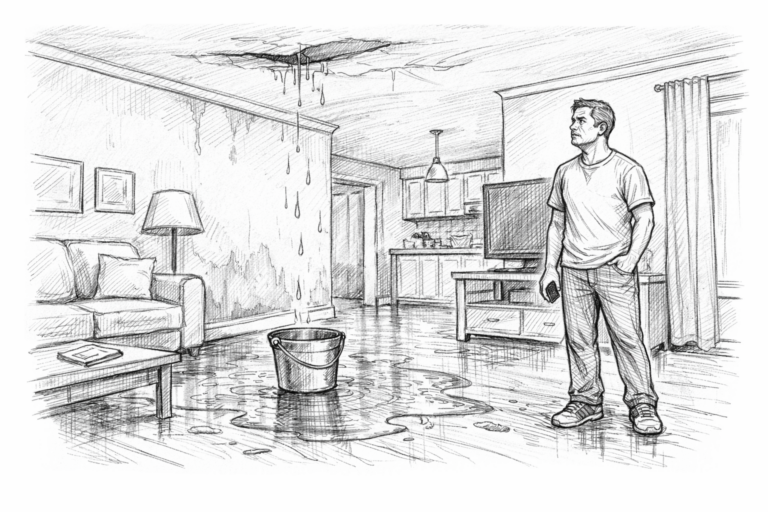

Water damage insurance claims can quickly become overwhelming when your home and finances are on the line. From burst pipes and roof leaks to appliance failures and storm-related flooding, water damage is one of the most common reasons homeowners contact…

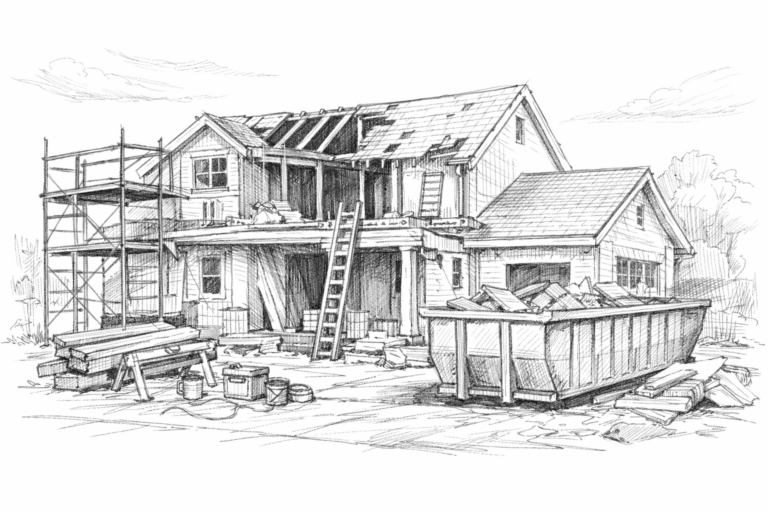

Renovating your house comes with excitement and risk. Without temporary home renovation insurance, that risk can quickly turn into financial stress. Many homeowners assume their standard policy is enough, only to find out it leaves major gaps when a project…

Renovating your home comes with excitement, noise, dust, and a fair amount of risk. Many homeowners don’t realize that their standard policy might not fully protect them during construction. That’s where temporary home renovation insurance comes in—it helps cover the…

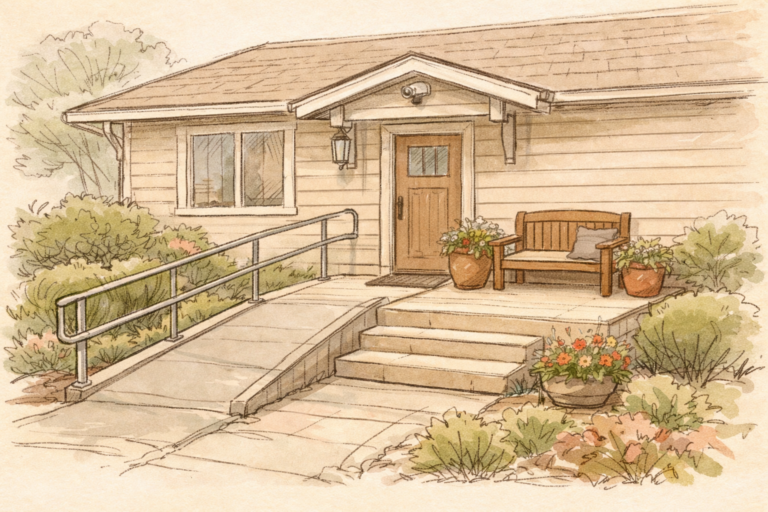

Senior home insurance plays a critical role in protecting your property and peace of mind during retirement. As you move into a new stage of life, your insurance needs often change, especially if you’re on a fixed income, downsizing, or…

The home appraisal insurance impact is often overlooked, yet it plays a major role in how much homeowners pay for insurance and what kind of coverage they receive. A home appraisal provides an objective estimate of a property’s value, which…

Managing multi-property homeowners insurance can be overwhelming if each home has a separate policy, provider, or set of terms. For anyone who owns more than one property — whether it’s a vacation home, rental unit, or inherited real estate —…

Custom homeowners insurance is essential when your property doesn’t fit the mold of a typical house. Whether you own a historic Victorian, a modern tiny home, or an off-grid cabin in the woods, standard insurance policies often fall short. That’s…